The word ‘Unicorn’ had probably never been used as much as it is right now among the Bharatiya early stage enterprise circles. In the Startup ecosystem, a unicorn is a fast growing enterprise that crosses the most prized billion dollar mark in valuation. Bharatiya Startup funding landscape is a sector that has seen unprecedented levels of growth in the past couple of years. While it was agreed that the Bharatiya economy was fuelled with a buoyant middle class and young demographics, the young entrepreneurs have contributed to putting Bharat’s name on the priority maps of early stage investors all over the world. The Startup landscape was unaffected even in the dark period of the earlier regime where the country’s reputation as an investment destination was dented by a series of shameful scams that rocked the nation. But following the result of Bharatiya general elections in 2014, the investor confidence in the Bharatiya early stage landscape has hit an all-time high while the investments in the first half of 2015 crossing the total amount of investments in 2014. This projects a whopping 100% growth assuming the investing spree continues (and it will!).

Some salient facts that would summarize the funding scenario in Bharat in the recent years

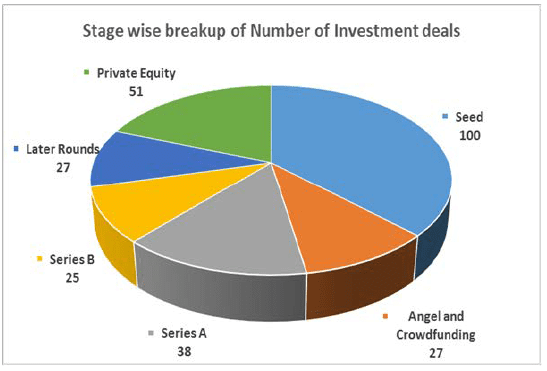

• According to Yourstory Research, In the first half of year 2015, around 380 deals have been closed in the angel and Venture capital stages totalling to an amount of $3.5 Billion (Yourstory is the leading startup focussed media house in Bharat)

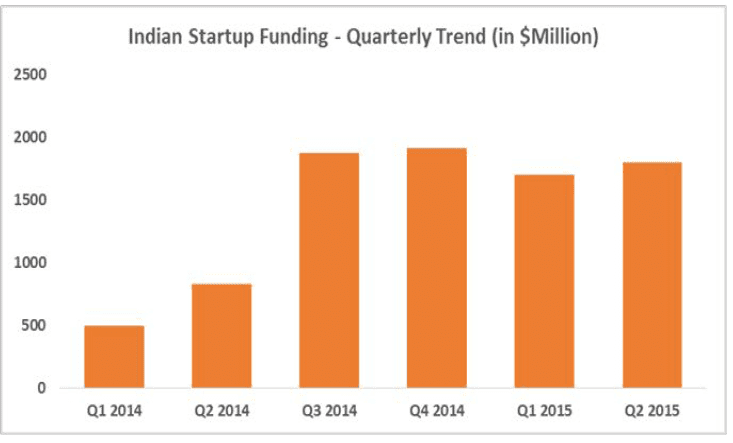

• In Q1 of year 2015, the number of deals done were 147 totalling up to $ 1.7 Billion. In terms of the number of deals, Bharat surpassed China. In terms of investment amount, Bharat saw a 300% growth w.r.t the amount invested in Q1 2014In Q2 2015, the investments both in terms of amount and the number of deals beat the Q1 milestones establishing the accelerated buoyancy in the early stage enterprises

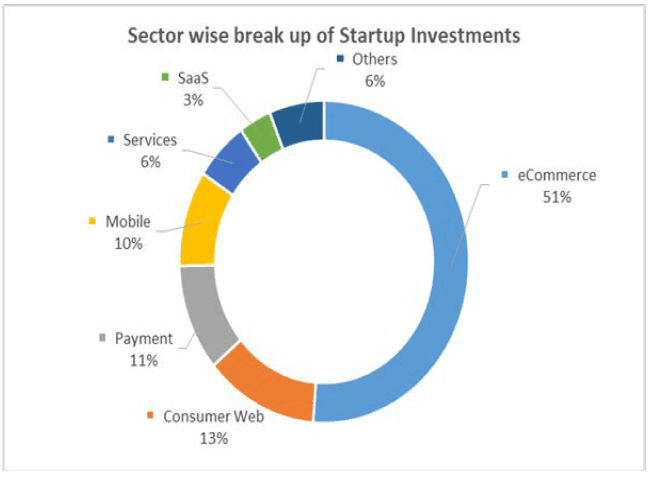

• Technology rules – Consumer focussed technology sectors like E-payments, E-Commerce, Mobile Technology have taken the lion’s share of the investment pie followed by Enterprise Technology and Technology enabled healthcare sectors

• Following the Prime Minister Sri Narendra Modi’s visit to Japan in 2014, Softbank, a Japanese Investment giant became the biggest investor in Bharatiya Ecommerce with large investments totalling to $1 Billion into companies like Snapdeal, OLA Cabs, Housing.com in the second half of 2014

• Bangalore and Delhi/NCR remain the favourite investment destinations with a number of tier 2 cities beginning to make a mark in the investment map Traditional industry icons like Ratan Tata have shown an active interest in the early stage enterprises like Bluestone, Cardekho, Grameen Capital, Kaaryah and One97 Communications

Funding trends and top deals

Investments into Bharatiya Startups by Venture Capital firms and Private Equity players witnessed a 126% surge QoQ in Q3 2014. This was largely due to large investments into Flipkart ($ 1.7 Billion in 2014) and also the entry on Softbank Corporation to Bharatiya ecosystem with investments totalling to around $ 1 Billion into fast growing consumer focussed players like Snapdeal, Olacabs and Housing.com.

(Note: The above graphic does not contain deals made in Q2 2015 due to unavailability of data)

Sectoral breakup

As we examine the sector wise concentration of investments, Ecommerce takes more than half the total investments followed by Consumer Web, Payments and Mobile sectors. The dominant sectors in the ‘Others’ category include Healthcare, Education and Technology sectors apart from Analytics, Hardware and Energy Sectors

The investor interest in Ecommerce and other consumer focussed sectors is expected to stay put given the favourable demographic dividend, growing internet and mobile penetration among the Bharatiya population and other macro factors. In the near future, it is also expected that Healthcare,Education and Fin-Tech startups to attract more investments.

Top Investors

• Large rounds of investments (ticket size of over $15 Million) had the most participation from Investment houses of global repute like Tiger Global, Sequioa, Helion Ventures, SAIF Partners and Accel Partners among others

• The Seed stage and Series A stage deals saw participation from IDG Ventures, Sequioa, Accel Partners, Helion Ventures and Bharat Quotient

• While Rajan Anandan and Sharad Sharma have been well known names among the angel investors in the recent years, the ecosystem is also witnessing many entrepreneurs like the Bansal brothers of Flipkart and Phanindra Sama (Redbus) don the investor apron. Industry icons like Ratan Tata and Mohandas Pai have shown a keen interest in the eco system

Future Outlook

The investor confidence is buoyant about Bharatiya early stage enterprises and it is expected that the seed and angel stage deals would go up in the coming months. Global investment houses stepped up their interest in early stage participation and the surge is expected to sustain. Time taken for a startup to achieve the coveted ‘Unicorn’ status has seen a decrease. The latest Unicorn Ola Cabs founded in 2011 took three years to get valued at One Billion dollars as against its Services counterparts like MuSigma (founded in 2004) which took around 9 years.

On the exit side, the recent acquisitions of Little Eye Labs (by Facebook), Zipdial (by Twitter) and Bookpad (by Yahoo) confirms the global interest in Bharatiya Technology enterprises. There have been around 190 Product acquisitions in the last 15 years out of which 28% have been from Global players. Bharatiya Startups have also started looking towards public issue as an exit route. After Justdial’s successful IPO in 2013, Infibeam filed its red herring prospectus and investors hope that the uptick in the macro-economic landscape hopefully opens up more avenues in the public markets too.

To end this in a personal note, my generation that graduated in the last decade had idolized NR Narayana Murthy and Sabeer Bhatia. The aspiring graduates today looking up to those Startup poster boys focussed on domestic markets startup poster boys like Sachin Bansal. It convinces me that the future of Bharat looks bright!